101.7 FM

88.1HD2

8.85 c

8.85 c101.7 FM

88.1HD2

Economists Expect Bank of Canada to Pause Interest Rate Cuts in April

BY Connect Newsroom, Mar 18, 2025 5:36 PM - REPORT AN ERROR

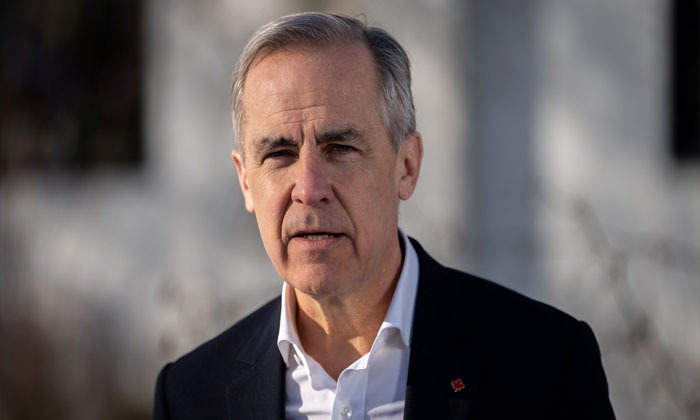

Money markets are pricing in a 65% chance that the central bank will keep rates steady during its next meeting on April 16.(Photo: The Canadian Press)

Economists and market participants are betting that the Bank of Canada will not cut interest rates next month, given the latest inflation data. Money markets are pricing in a 65% chance that the central bank will keep rates steady during its next meeting on April 16.

With February's inflation data and the potential for further increases due to tariffs, the Bank of Canada may temporarily pause its rate-cutting cycle in April.

Economists at National Bank and Benjamin Reitzes, an economist at BMO Capital Markets, have expressed similar expectations. Reitzes noted that the removal of the carbon tax could ease inflation in April, but the impact of the tax holiday ending in February might be felt in March. As a result, the central bank is expected to take a cautious approach at next month's meeting.

Share on

Related News

Sign up for the newsletter

We'll deliver best of entertainment right into your inboxWe love to hear from our listeners, so feel free to send us message